ny paid family leave tax code

Nonprofit entities that are compensating individuals for their services are required to obtain disability and paid family leave benefits coverage for all employees with the following. Intuit Accountants Community.

Paid Family Leave Policies And Population Health Health Affairs

New York updates its State Average Weekly Wage every year.

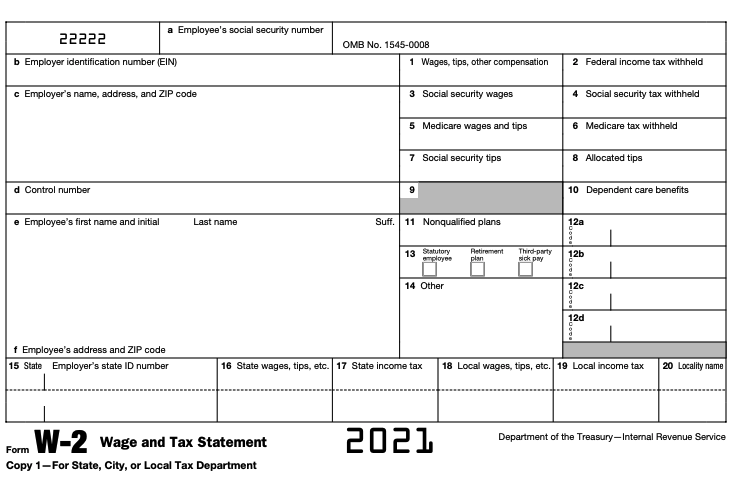

. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form. New York State intends Paid Family Leave to be funded entirely by payroll deductions from covered employees. Pursuant to the Department of Tax Notice No.

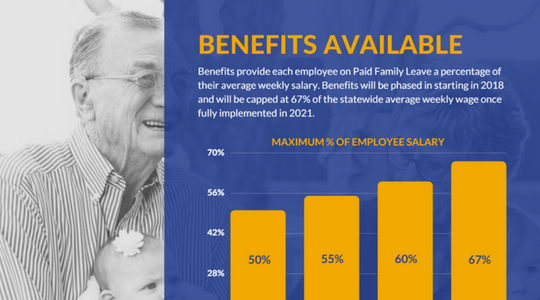

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. That means the maximum weekly benefit for Paid. Sep 11 2022 The program originally enacted in 2016 is now fully implemented providing up to 12 weeks of paid leave to bond with a newborn adopted or fostered child or to care for a.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Use of NY Family Leave. In 2019 its 135711.

For 2022 the deduction will be 0511 of a covered employees. As of January 1 2021 must provide up to 56. Ny paid family leave tax code Friday March 11 2022 Edit.

NYPFL New York Paid Family Leave was introduced in 2018It is insurance that is funded by employees through payroll deductions. New York State Department of Labor - Unemployment nygov. NY Paid family leave.

ProSeries Tax Idea Exchange. Employers have the option to pay on behalf of their. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program.

At 67 of Pay Up to a Cap Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Now after further review the New York Department of Taxation and. They are however reportable as.

The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. Beginning January 1 2018 employees may use paid family leave. The state of New York has implemented a Paid Family Leave program funded by the collection of taxes from the employee.

To bond with the employees child during the first 12 months after the childs birth or after the. New Yorks states Paid Family Leave PFL. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

The maximum annual contribution is 42371. New York Paid Family Leave Benefits 2019 to 2021.

New York Paid Family Leave Rates For 2021 Hr Works

New York Paid Family Leave 2021 Contributions And Benefits Schulman Insurance

How 4 Weeks Of U S Paid Leave Would Compare With The Rest Of The World The New York Times

How To Read Your W 2 Justworks Help Center

How To Build A Paid Family Leave Plan That Doesn T Backfire The New York Times

Free Pdf Guide Understanding New York Paid Family Leave

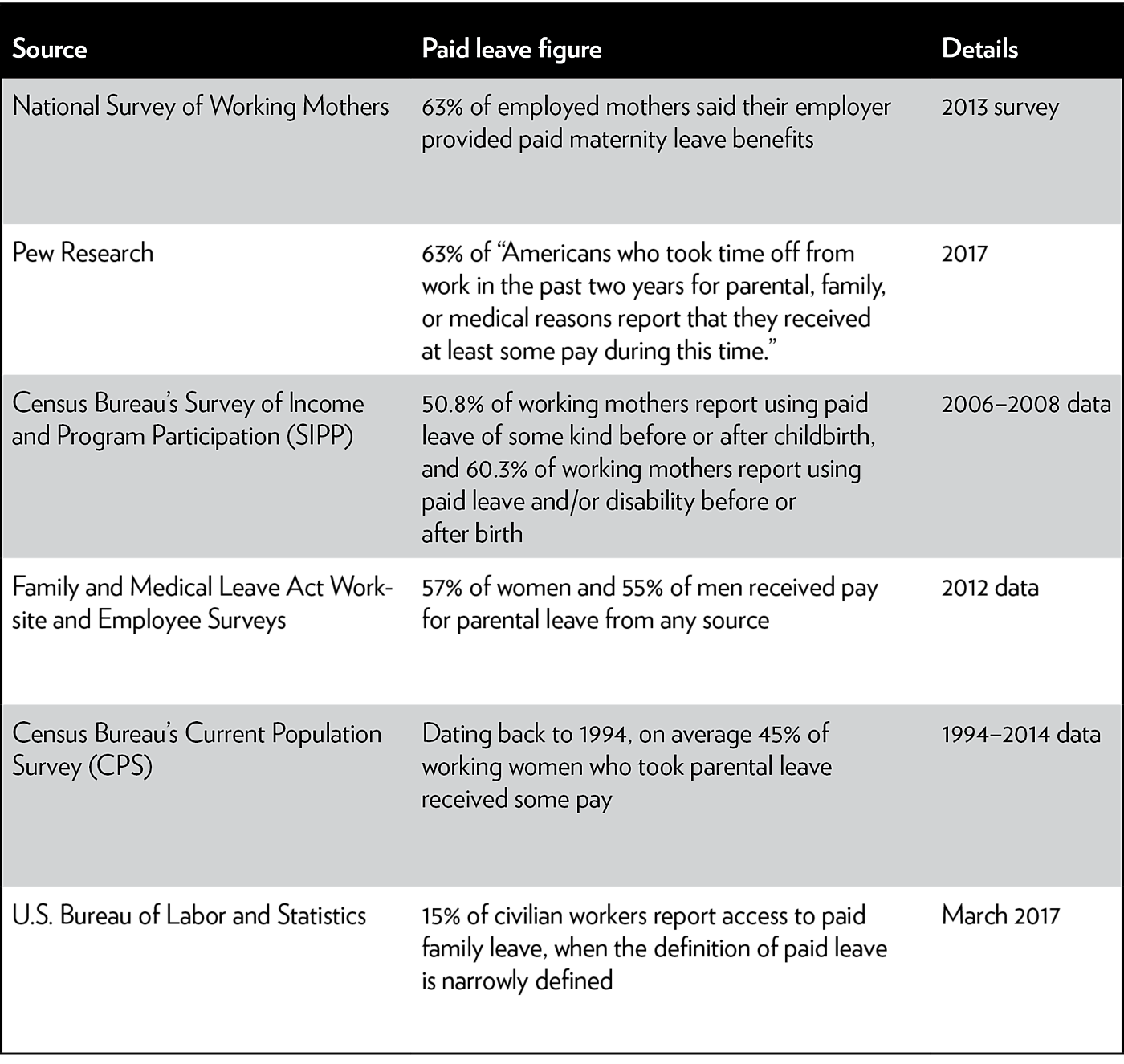

Parental Leave Is There A Case For Government Action Cato Institute

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

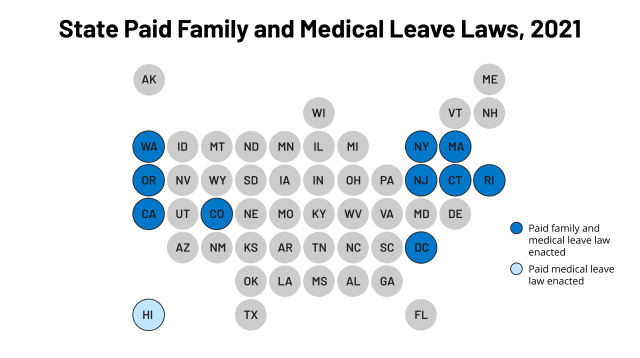

State Paid Family Leave Laws Across The U S Bipartisan Policy Center

New York Paid Family Leave 2021 Contributions And Benefits Schulman Insurance

Tax Implications Of New York Paid Family Leave Gtm Business

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

2021 State Paid Family And Medical Leave Contributions And Benefits Mercer

New York Employment Law Update Constangy Brooks Smith Prophete Llp Jdsupra

Sales Taxes In The United States Wikipedia

Daycare Paid Maternity Leave Why Us Is Still Bad For Working Parents